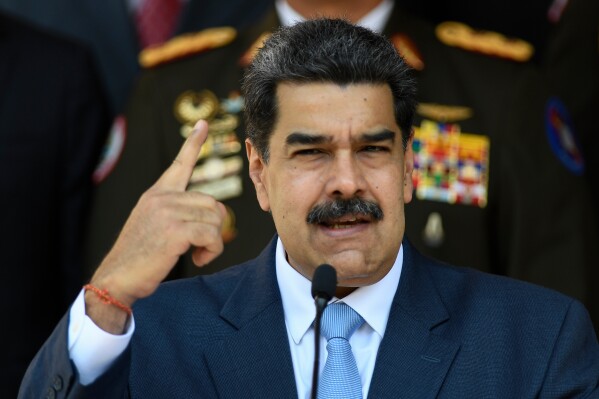

Prediction markets let people wager on the outcome of events, from a basketball game to a presidential election. They’ve even included speculation about the recent downfall of former Venezuelan President Nicolás Maduro.

The latter is drawing renewed inspection into this dark world of speculative, 24/7 transactions. An anonymous trader pocketed more than $400,000 last week, after betting that Maduro would soon be out of office.

Fueling online suspicions of potential insider trading due to the timing of the wagers and narrow activity of the trader on the platform, the bulk of the bids of the trader on Polymarket, a platform, were only hours before President Donald Trump announced the surprise nighttime raid that led to the capture of Maduro. Others argued that the risk of getting caught was too big, and that last speculation about the future of Maduro could have led to such transactions.

Polymarket did not respond to requests for comment.

Prediction markets allow people to wager on the likelihood of a growing list of future events. Their commercial use has skyrocketed in recent years. Yet, traders still lose money daily in spite of some eye-catching windfalls. Regulators categorize the trades differently from traditional gambling, raising questions about transparency and the risks involved under U.S. government oversight.

Prediction markets cover a wide range of topics. These can include geopolitical conflicts, pop culture moments, and even the fate of conspiracy theories. However, there’s been a surge of wages on elections and sports games previously. Users have wagered on everything from whether the U.S. government will confirm extraterrestrial life to how much billionaire Elon Musk might post on social media this month. Some have even bet millions on rumors, like the rumored — and ultimately unrealized — series finale of Netflix’s Stranger Things.