The Campaign for Fairer Gambling (CFG) has released a new report. It shows that consumer losses escalate when states legalize online gambling without effectively targeting the unlicensed sector.

The newly released supplement to CFG’s 2024 USA National Online Gambling Report was created in partnership with market intelligence platform Yield Sec. It evaluates online betting trends across all 50 U.S. states.

The report concludes that consumer harm rises sharply in states where online gambling has been partially or fully legalized. This is especially true when there is little to no enforcement targeting unlicensed operators.

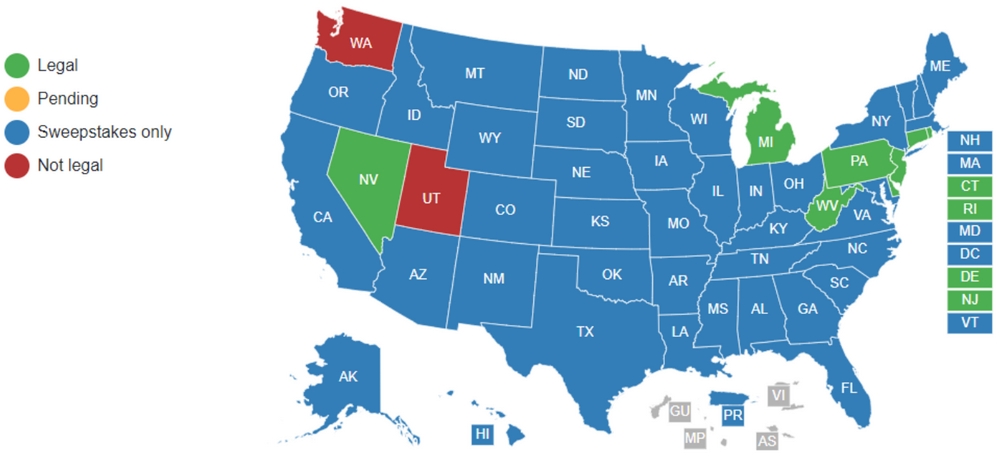

CFG’s analysis divides states into three categories based on their regulatory frameworks. The first includes states with no legal online gambling, such as California and Texas. The second includes states that allow only online sports betting, like New York and Florida. The third includes states that permit both online sports betting and online casino games, such as Michigan and New Jersey.

The report compares the extent of betting losses across these regulatory categories using GGR per capita as a percentage of average income in the past year.

According to the report, the national average for combined licensed and unlicensed online gambling GGR per capita is 0.62% of average income. The figure is significantly lower, at 0.31% of income in states without any forms of legal online betting.

Nevertheless, GGR per capita rises to 0.77% of average income in states that have legalized only online sports betting.

In states where both online sports betting and online casino gambling are legal, the GGR per capita rises to 1.12% of income. This is about 3.6 times higher than in states with no legalized online betting.

The data suggests that legalized online gambling has failed to displace or significantly reduce illicit gambling activity. Instead, the legal and illegal markets continue to operate side by side.

The original national report states that 74% of total online GGR in the U.S. currently goes to unlicensed operators. This, along with other reports, highlights the vast scale of the unregulated market.