Industry groups and punters warn that the new tax hikes could squeeze pay-outs. They could also strain operators. The changes may push more betting into unregulated spaces.

Zimbabwe’s newly announced gambling taxes have drawn sharp criticism from industry groups, betting operators, and financial analysts. They warn that the measures could destabilize the sector and harm ordinary punters.

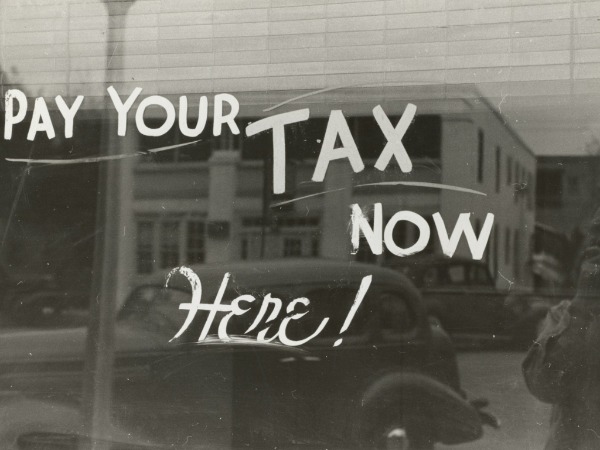

Finance Minister Mthuli Ncube unveiled Zimbabwe’s 2026 national budget, which raises the withholding tax on punter winnings from 10% to 25%. It also increases the final tax on bookmakers’ gross revenue from 3% to 20%. The new rules take effect on January 1. The government says the changes aim to capture revenue from the booming gambling sector and curb social harms linked to betting.

Equity Axis, a local betting industry association, said the taxes punish ordinary citizens and licensed operators. They do not address the root causes of economic hardship, the group added.

Analysts warn that the 20% levy on gross revenue could push smaller operators to the brink. They also say the 25% tax on winnings drastically reduces net pay-outs for punters. Experts warn that the measures could lead to job losses, outlet closures, and a shift toward unregulated betting.

ZimEye reports that an analyst monitoring Zimbabwe’s betting industry said the government is squeezing a sector that provides both employment and entertainment. Instead of fixing spending inefficiencies or tackling corruption, the measures target the gambling industry.

An African iGaming report describes the changes as one of the most significant overhauls of Zimbabwe’s gambling regime. It warns that higher costs for both punters and operators could stifle growth instead of stabilizing the sector.